My Say – No. 68

24th July 2021

WELL, WHAT A SURPRISE

I am grateful to Jonathan Shapiro, an Australian Financial Review journalist, for a sobering reminder as the ETF mania continues to gather pace. I have tried to expose the ineffective structure of the old-fashioned managed fund (unit trust) that is the basis of an ETF but with little success. I was therefore heartened by a louder voice than mine joining the fray.

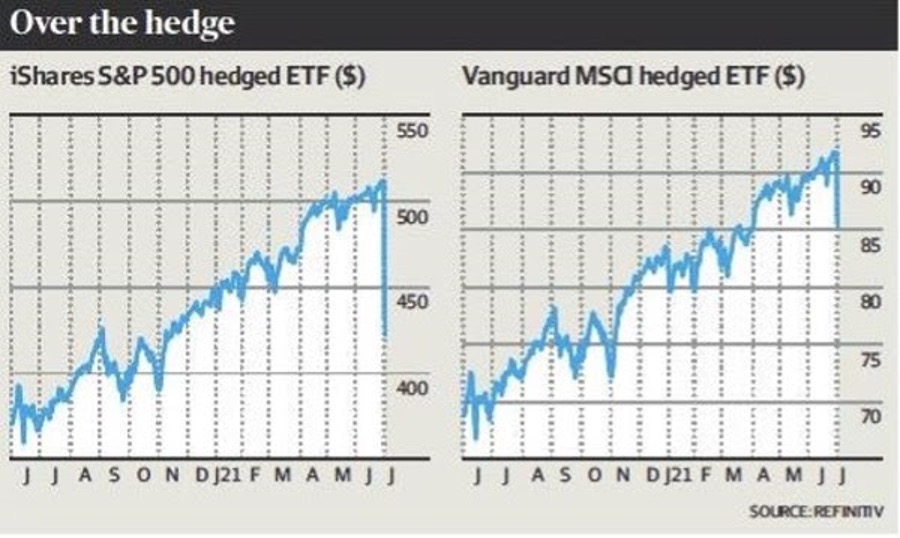

Basically, the iShares S&P 500 hedged ETF and the Vanguard MSCI hedged ETF delivered a nasty shock to some of their investors. With both funds hedging the currency for Australian investors, a large gain as a result of this hedging was distributed to investors after 30th June this year.

Despite a stellar performance by both funds last financial year, on the last day, the Vanguard fund fell 7% and the iShares fund 17.5%. This was caused by large payouts as the hedging profits had to be distributed (as dividends) and were taxable. Commentary on Reddit indicates some surprised and less than happy investors.

In view of this I would ask you to consider the following blog that underlines more of the issues associated with the trust structure as an investment vehicle.

https://www.sharesight.com/blog/the-exchange-traded-fund-etf-tax-nightmare/

Readers of my newsletter will be aware of my bias that is pro listed investment companies as they carry none of the baggage above.

A recent response to a Firstlinks article displays some of the ignorance in relation to LIC’s. For some strange reason they are treated as being quite different to every other company listed on the exchange.

1. “There is no new money coming in, so the only way LIC can buy is by selling something (not good in down market) or using their modest cash holding. Or do you want an LIC manager to hold a lot of cash waiting for a downturn? That ensure under performance in a rising market which probably increases the discount due to LIC investors selling.”

The primary functions of the share market are twofold. First, to enable companies to raise capital and secondly, to provide a mechanism for you and me to exchange for value ownership of those shares. The fact that it often appears to be treated like a casino speaks volumes about the behaviour of humans. On any given day the sharemarket is a barometer of the greed, fear etc of humans. Add to that the activity of hedge funds, day traders, short sellers etc and everyone thinks the sharemarket is risky. But why shoot the messenger?

I have looked back over the last 20 plus years at my LIC holdings and am pleased to report that I have enjoyed over 30 opportunities to purchase additional shares with no brokerage and usually at a small discount. All were capital raisings by the LIC’s to bolster their balance sheets. So, LIC’s have no shortage of access to cash to invest on behalf of their shareholders.

Before anyone criticises a LIC for holding cash, would you also level that same criticism at all the other companies listed on the stock exchange that hold cash on their balance sheets?

Most companies declare a payout ratio, that is, the percentage of the annual profits they will distribute to shareholders as a dividend. The balance, retained earnings, are kept on the balance sheet for research, technology, innovation, etc.

For example, let’s look at Commonwealth Banks Payout ratio in 2021 as stated on their website.

What is CBA’s dividend policy?

Commonwealth Bank of Australia will seek to:

- pay cash dividends at strong and sustainable levels;

- target a full-year payout ratio of 70% – 80%; and

- maximise the use of its franking account by paying fully franked dividends

The only difference for the old fashioned LIC’s is that they don’t have the manufacturing, input costs and service base like banks, supermarkets, manufacturers etc, they are simply long-term investors in these other businesses thus their ‘payout ratio’ is substantially higher and retained earnings lower.

If one reads the objectives of these older LIC’s (refer My Say 66) they are simple: The generation of a growing tax effective income stream combined with long term capital growth.

It follows therefore, that listed investment companies like any other company are perfectly justified in running their companies just like any other company. They are justified in holding cash or running debt on their balance sheets just like all other companies. ETFs are in another realm. Their capital base is subject to the ebb and flow of sales and redemptions.

A parallel with much of Australian industry during the GFC would be worthwhile remembering. At that time credit markets around the world had locked up and the only source of capital available to companies were existing shareholders. A huge flow of capital raisings flooded the market as companies bolstered their balance sheets during a rather difficult period. Companies can and do raise capital for a variety of reason, buying another business, paying down debt etc. Vive la sharemarket.

Oh, by the way, I have a huge list of capital raisings by other companies (non LICs) in my share portfolios stretching back decades and, as I write this, I am waiting for the latest capital raising by one of my favourite LIC’s, Whitefield.

They are offering a share purchase plan (SPP) to existing shareholders where we can buy up to $30,000 worth of shares with no brokerage and a small discount. These have been a wonderful discipline for introducing our sons to investing. A regular source of saving with no; “what do you think Dad, is it the right time to invest?” They just did it which has put them ahead of where Frieda and I were at their age.