Idle time had me looking back over My Say articles from 2002. Brought a few smiles to my face.

I thought I might revisit one of them as I can then avoid reinventing the wheel by trying to pen a fresh article. It will also underline my unchanging attitude to investing.

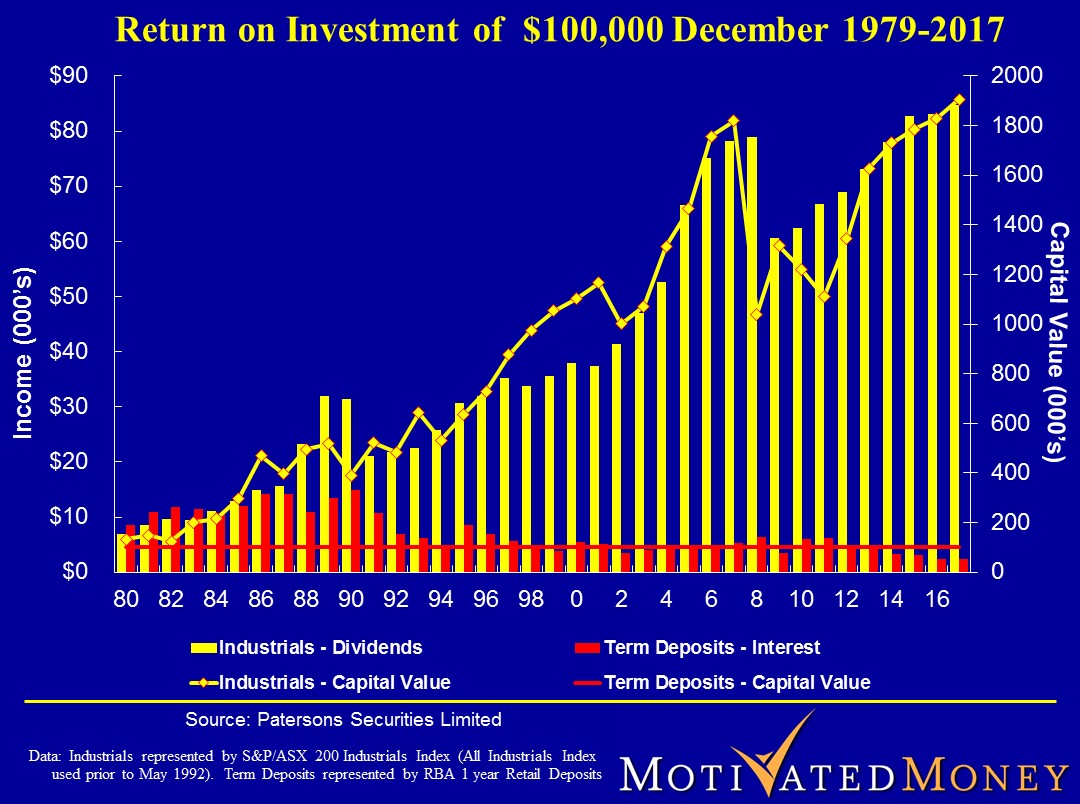

I will leave it as it was written back in 2005 apart from an update to the chart that was included at that time.

Welcome to my first epistle for 2005. What a start to the year it has been with the All Ords up around 28% during calender 2004! This follows gains of 16% the year before. It wouldn’t be hard to feel very smug about how clever one is when portfolios are awash with unrealized capital gains. Just don’t forget, it could all be gone tomorrow.

In some respects it has also been frustrating. When prices run this hard it is often difficult to find value. Remember the rules; price and value at times of sharp movements are often inversely related.

Despite the prices of some stocks rising by 40, 50 and 60 per cent, the value of the business is often not much different to what it was 12 months ago. What changed was merely perception.

Others seem to share this view of an overpriced market. Some of you may also have read the article by Barry Dunstan in the AFR on Friday, 4th February. He was discussing the market direction with a financial planner come economic forecaster.

What was a relief to me was that the subject of the interview has found the ‘alchemists stone’.

He was able to dismiss all other forecasters as inaccurate and lays claim to having the only reliable methodology for making asset allocation decisions. Whew, big call.

This gentleman is modestly forecasting a ‘fair value’ for the Australian market of 3200, not the current 4000 points. He then goes on to suggest the returns that investors can expect from equities over the next seven years.

He also issues a challenge to all who disagree to “feel free”, as long as they can demonstrate the reliability of the methodology they prefer to use, to make their forecasts. This is an even bigger call from someone who declines to elaborate on the detail of his model and gives us the glib assurance that “rocket science is not involved”. I digress.

Whether we see 3200 or not is of little interest. It is just another number. The mindset associated with round numbers is extraordinary.

I don’t know whether any of you are aware of the commentary as we approach a ‘big number’ on the index.

Whether it is 10,000 on the S&P or 4000 on the All Ords, we are confronted with the almost daily ‘will we-won’t we’, and once achieved, it becomes “can we sustain it?”

Can anyone remember the first time we went through 1000 points? It was late 1985: All to be forgotten when we went through 2000 points in July1987.

This was followed by a correction and we did not pass it again until October 1993. We were bored again until April 1999 when we hit 3000. Now we have the magic 4000 under our belts in December 2004.

All this will then be forgotten until the next ‘big number’ on the index approaches when we will go through the whole sorry process all over again. Unless of course we fall back and then have to take another run at the 4000 level.

In the meantime it will be up and down like the proverbial. Trying to look into the future for asset allocation plays is not really part of my investment philosophy.

As I foreshadowed in my last newsletter, it is time for the annual updates and I have included my ‘mothership’ slide.

For those of you unfamiliar with this image, it compares the value and income from cash and industrial shares over the 35+ years that the data has been available.

Despite the ups and downs over that time, the stability of the dividend stream shines through and it is this that forms the basis of investment success long term.

The companies pay dividends depending on payout ratios (the yellow bars) and the balance is retained to grow the business (the yellow line).

Whilst we are working we can also reinvest those dividends as well and compounding over time does all the hard ‘yakka’ for those who are patient.

To me, most of the forecasting is just noise. It is mostly contradictory (despite the alchemists stone having now been found) and isn’t worth a tuppenny toss.

The yellow line will inevitably follow the yellow bars and the short term gyrations around the mean, or volatility, merely reflect attitudes or sentiment at the time.

These ups and downs are only really useful as an indicator for me to perhaps increase my purchases whilst prices are low but not much else.

With dividend season again approaching I look forward with mindless anticipation to watching the cheques roll in. It seems like only yesterday that the dividends from the previous reporting period stopped.

Maybe that is a sign of age (or failing memory!).

Knowing that we will repeat the past I remain sanguine about the future. If not, what else is life for?

On a current note, it is with some regret that I have to announce the discontinuance of the course I tutored for 13 years at the Centre for Continuing Education at Sydney University; apparently it had become irrelevant. I can only hope they are referring specifically to the course and not the tutor.

From time to time I will have the opportunity to repeat the full day session now cancelled by CCE and will post dates on the website under ‘Public Speaking’.