“The surest way to corrupt a youth is to instruct him to hold in higher regard those who think alike than those who think differently.” (Nietzsche)

With the longer-term effects of Covid19 becoming more apparent by the day I was reminded of another asset class that deserves a critical review, Listed Property Trusts (REITS). The catalyst for this was an article in the SMH dated 6th June with the headline “Investors pump more than $2b into listed property market”.

I was reminded of a similar article I had captured in June 2019 titled, “REIT raisings at highest levels since 2010”. The reason this article had caught my eye was a quote, “The comments come as bankers expect more REIT raisings in coming months, as companies move to make the most of equity market appetite for REITs in light of the wider interest rate environment”.

Justification for using REITS has always largely been based on the higher yields they offer as opposed to other assets. Read My Say No 60 for the detail of this silly issue of yield versus income.

I addressed this issue back in 2013 (My Say No 47) following an article in a weekend paper highlighting the fact that Coles has just unloaded the majority ownership of 19 shopping centres into one of the country’s largest super funds; perhaps a reason to look elsewhere for your super savings!

Coles was purchased by Wesfarmers and the article reminded me of what happened when Wesfarmers, under the hand of Michael Chaney, bought the Bunnings chain. They offloaded the warehouses into a trust (BWP) in 1998 and floated it releasing valuable capital back into their business.

As property trusts must distribute 100% of their ‘income’ to avoid adverse tax implications they have no retained earnings which are available to most companies. This means purchases, redevelopments and new developments etc must be funded by either borrowings or fresh capital. As I was reminded by a good friend, retained earnings are the cheapest form of capital available to public companies; not property trusts!

To give you some indication of how cash-hungry property trusts are I have listed below the capital raisings since BWP was floated:

Feb 2000: 1 for 3 to raise $44 Mill

Sep 2001: Placement to raise $23.9 Mill

Nov 2001: 1 for 8 to raise $29.5 Mill

Nov 2002: Placement to raise $33 Mill

Nov 2003: UPP to raise $25 Mill

May 2009: 1 for 3.09 to raise $150 Mill

Feb 2011: 1 for 4.84 to raise $150 Mill

May 2017: $110 Mill medium term note issue

In 2012, Woolworths floated a property trust, Shopping Centres Australasia (SCA) to get their property off the balance sheet.

In 2004, Westfield Holdings (the management company) and Westfield Trust (the shopping centres) were stapled together. Subsequently, the Lowy family pulled the staple in 2014 from Westfield Group (WDC) to separate again the management from the Westfield properties. It would not have gone unnoticed that the Lowy family company (LFG) subsequently dumped $663 million worth of Westfield Retail Trust (WRT) to get the property off their balance sheet.

The statement from a Lowy Family Group (LFG) spokesperson regarding the sale was as follows: “the sale was made as part of a broader investment strategy to diversify its investments internationally”. Basically, they are going back to their previous strategy of investing in every other aspect of property such as development, management, etc and avoiding the physical ownership.

Longer term we have been watching as banks off load their branches to ‘investors’. It will be interesting to see as time passes how many of the leases are renewed as bricks and mortar gives way to virtual operations. I have become increasingly aware of the number of original bank buildings now being used as restaurants, antique shops, etc.

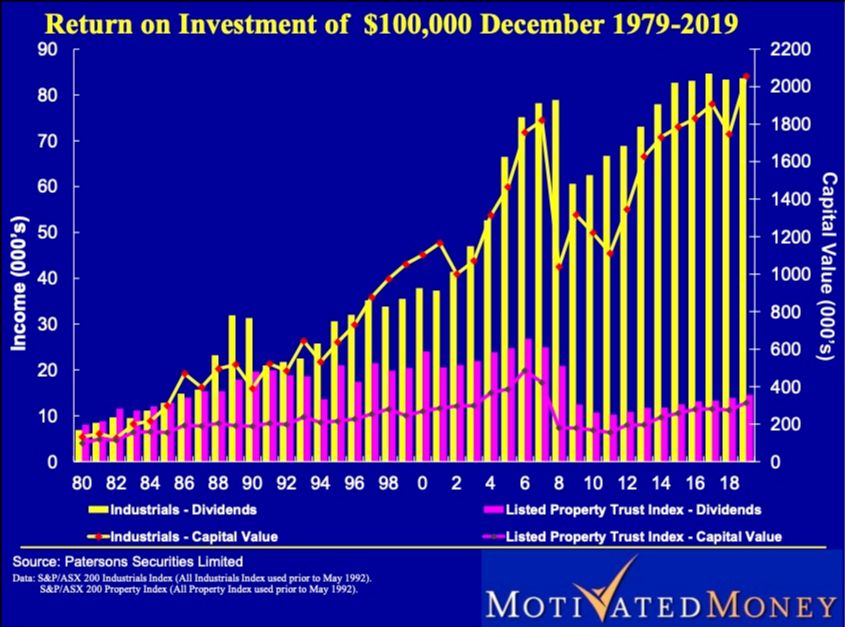

This process of businesses selling off property has been underway for some decades now as the realisation sinks in with company management that capital is better employed in the business rather than ownership of fixed assets, particularly property. The chart below demonstrates why this exodus from property makes commercial sense.

The yellow is the industrials index whilst the mauve is the listed property trust index. As I have mentioned previously; apart from speculative activity, why anyone would think property is a better investment than shares amazes me, particularly with regard to income.

Whilst observing the difference between the two I should mention that the listed property trust sector spent a large part of the period between 1994 and 2005 quadrupling its debt levels. Needless to say, the effects of this behaviour are clearly displayed in the subsequent performance (dare I mention Centro?).

I repeat, read My Say No 60 https://motivatedmoney.com.au/my-say-no-60-oh-no-not-again/

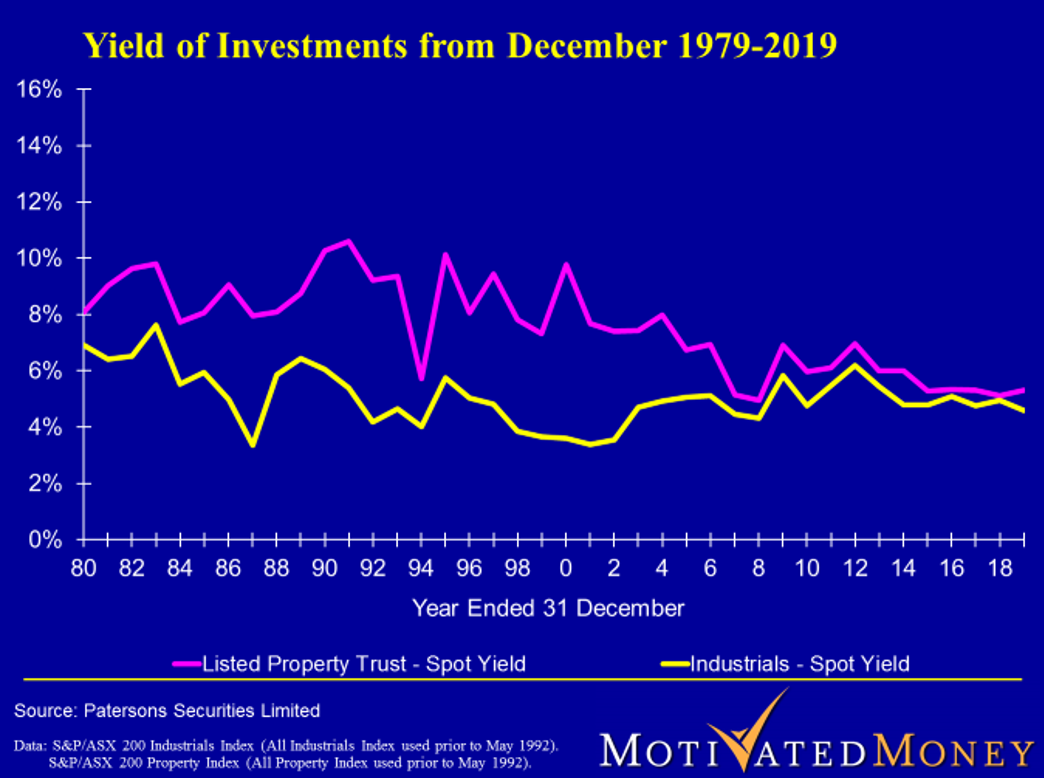

Although REITs are high yielding (see below) their income, above, leaves a great deal to be desired.

A further observation; as listed property forms part of the industrials index ( they make up more than 7% of the ASX 200 Index), by ignoring listed property trusts one should be able to harvest a tidy out-performance of the benchmark index by simply not holding property over the longer term.

Two things of note; the 5th edition of my book has sold out and the updated 6th edition is now off the printing press.

Secondly with the gradual easing of restrictions I am looking forward to restarting the full day workshops.

When available, details will appear on the website under the Public Speaking button.

In the meantime, stay safe and positive (grin).